- About Us

- Case Studies

- – Show all –

- Commercial valuation of a gas reservoir

- Market study of Waste-to-Energy industry

- High Throughput Satellite (HTS) market forecast

- Turnaround strategy for a telecom operator

- B2B segmentation & ICT product roadmap

- Myanmar industrial park development business plan

- Performance appraisal & action plan workshops

- Strategy case studies for management development program

- Contract farming management software for market validation

- Valuation of wind farm financial impacts

- Social media marketing analysis & tracking reports

- Clients

- Careers

Case Studies: 10

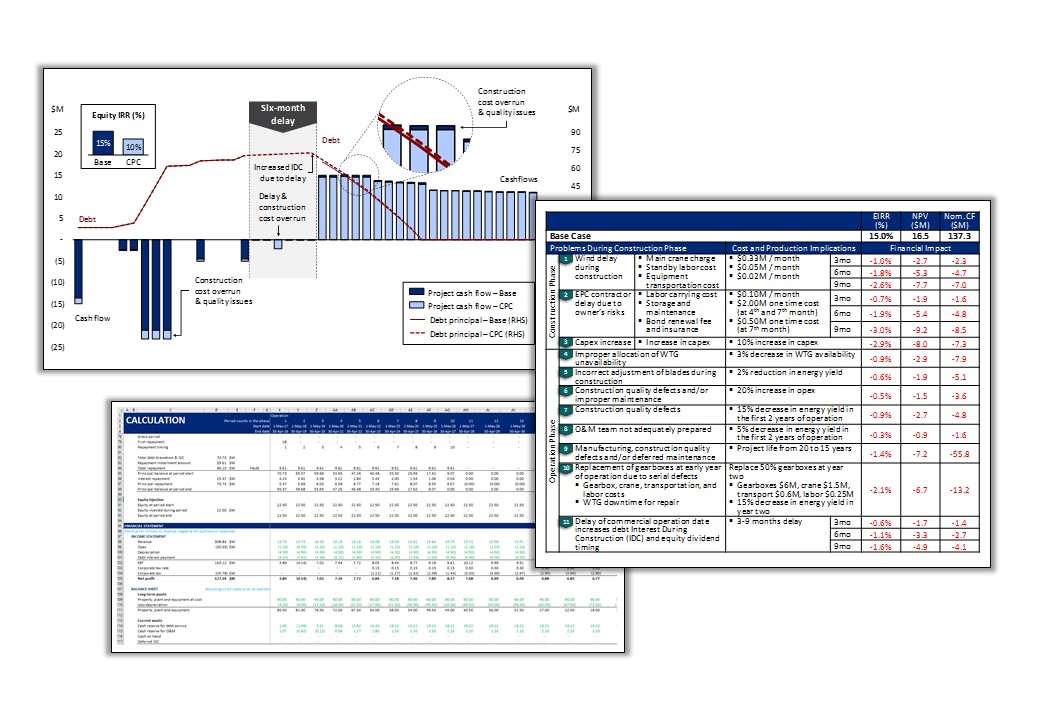

Valuation of wind farm financial impacts to equity investor from construction problems

Background

- The client is an experienced wind farm & solar farm project development and management company

- Renewable energy projects are typically subject to high and all-rounded risks in development and construction phases. These projects will realize higher valuations at later phrases as they are de-risked

- The client sees an opportunity to co-own new projects by utilizing its unique expertise and well-established track records

- The client requires assistance on quantifying the potential value creation to the project from its expertise

Role and methodology

- Develop a financial model for a typical 50-MW with 20-year operation, 75% debt financing and with detail construction capex and potential delay and performance parameters

- Cash flow analysis and valuation of project and equity return of normal case vs potential construction problems

- Develop a memorandum of financial impacts from potential construction problems of a typical wind farm project

Project outcome

- Valuation of financial impacts (to project and equity owners) from potential construction problems in three categories:

- Construction delay

- Cost overrun

- Impaired performance

- A memorandum which serves as a marketing material distributed to target renewable project owners

Keywords: Wind Farm, Valuation, Financial Model, Project Finance, EPC, Construction Management

Who We Are

Avid Analysts is a Bangkok-based boutique management consulting company founded by a group of professionals whose capabilities have been behind improvement and competitiveness of leading companies. We share the same Core Values which are pillars of our work to be delivered to our clients

Site Map

Contact Us

No. 1 Glas Haus Building, Floor P, Sukhumvit 25, Sukhumvit Road, North Klongtoey, Wattana, Bangkok 10110, Thailand

+66 2 402 5211

info@avidanalysts.com

Copyright @ 2016 Avid Analysts Co., Ltd.