- About Us

- Case Studies

- – Show all –

- Commercial valuation of a gas reservoir

- Market study of Waste-to-Energy industry

- High Throughput Satellite (HTS) market forecast

- Turnaround strategy for a telecom operator

- B2B segmentation & ICT product roadmap

- Myanmar industrial park development business plan

- Performance appraisal & action plan workshops

- Strategy case studies for management development program

- Contract farming management software for market validation

- Valuation of wind farm financial impacts

- Social media marketing analysis & tracking reports

- Clients

- Careers

Case Studies: 01

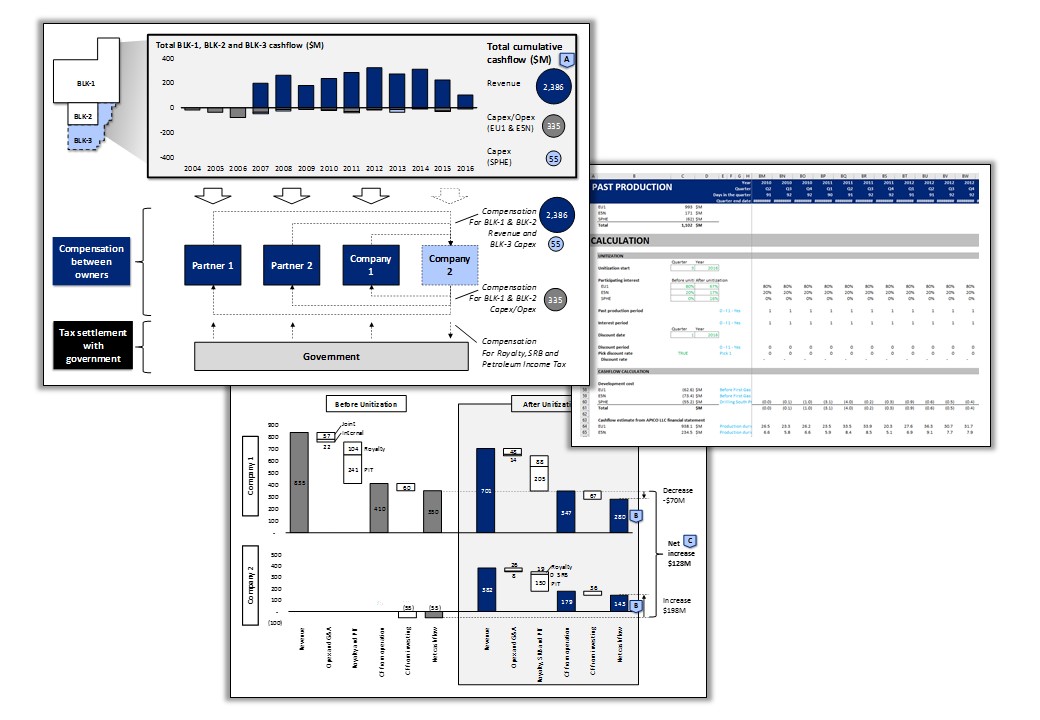

Commercial valuation of a gas reservoir undergoing a unitization agreement

Background

- The client who is an oil & gas exploration and production company discovers that their wholly owned reservoir is connected to a nearby reservoir in which they partially own in a JV

- Although unitization is new in Thailand, it is a worldwide practice in which concession owners join connected reservoirs into a unit operation and each owner gets corresponding share for revenues and costs

- The client would like to determine how much they should claim for their share of historical production and also weighing the tradeoff if they pursue the future production as a wholly owned standalone

Role and methodology

- Unitization agreement depends largely upon negotiations between concession owners which is typically subject to various possibilities

- Identifies key strategic parameters which are oil price, participating interest, unitization timing, fiscal regime change of participating concession blocks

- Develop a financial model to incorporate all key parameters, and determine the loss/gain of each owner including government take

Project outcome

- Provide commercial value of different market scenarios and corresponding gain/loss to each owner including the uncertainties in negotiation process e.g. loss in commercial value per delay time

- The result helps the client management make decision on the concession and support the negotiation process

Keywords: Oil & gas, Unitization, Valuation, Financial Model, Petroleum Act, Petroleum Income Tax

Who We Are

Avid Analysts is a Bangkok-based boutique management consulting company founded by a group of professionals whose capabilities have been behind improvement and competitiveness of leading companies. We share the same Core Values which are pillars of our work to be delivered to our clients

Site Map

Contact Us

No. 1 Glas Haus Building, Floor P, Sukhumvit 25, Sukhumvit Road, North Klongtoey, Wattana, Bangkok 10110, Thailand

+66 2 402 5211

info@avidanalysts.com

Copyright @ 2016 Avid Analysts Co., Ltd.